100 Group Committees

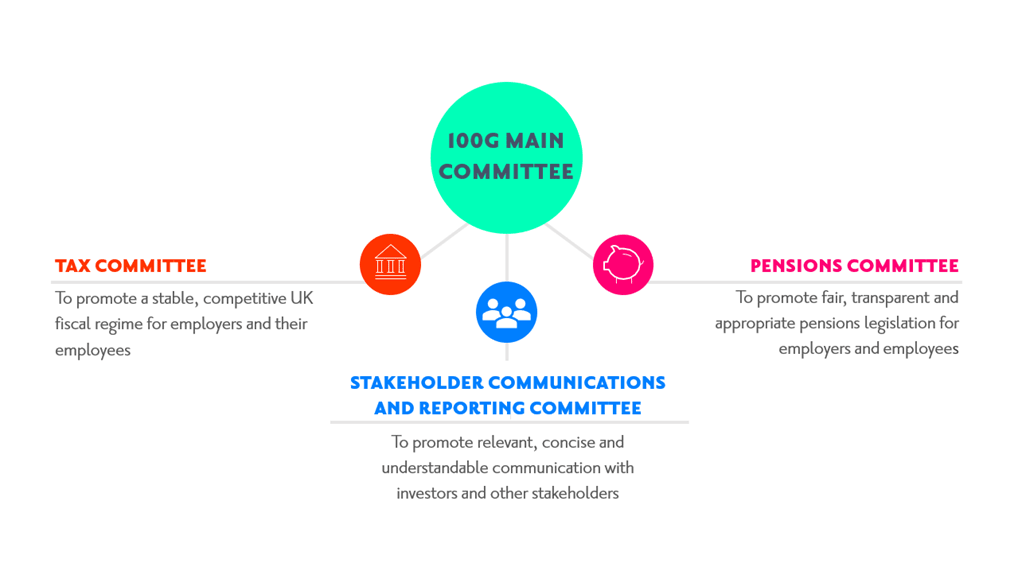

A Foundation For Financial StabilityThe 100 Group is organised through a structure of committees. Each committee meets once a quarter to debate emerging topics on the agenda of Finance Directors.

The main committee determines the overall strategic direction of The 100 Group, and delegates responsibility for action to the sub-committees. Each sub-committee is chaired by a member of the main committee.

Committee meetings are held in private, and guests are invited by the committee chairman.

Main

Committee

By engaging on domestic and international finance and regulatory matters we work to promote the UK as a competitive choice for investment and support long term economic growth.

Stakeholder Communications And Reporting Committee

Our aim is to promote relevant, concise and understandable communication with investors and other stakeholders, to support them in making rational economic decisions.

Pensions

Committee

Our aim is to promote fair, transparent and appropriate pensions regulation for employers and employees, which encourages long term investment in UK Plc.

Tax

Committee

Our aim is to promote a stable and competitive fiscal regime for employers and their employees, enhancing the competitiveness of the UK and delivering consistent revenue to the UK government.

The 100 Group Main Committee

By engaging on domestic and international finance and regulatory matters we work to promote the UK as a competitive choice for investment and support long term economic growth.

Our Role

The main committee is responsible for setting the strategic direction of The 100 Group. We meet regularly with representatives from the UK Government, the Institute of Chartered Accountants of England and Wales, the Financial Reporting Council, The UK Endorsement Board, investor groups and similar bodies across Europe, as well as with peer Networks such as the GC100 and A4S.

We communicate with the membership through networking events, emails and through our online presence. The committee’s day-to-day activities are supported by KPMG.

Our Chair – Anna Cross

Anna was appointed as Group Finance Director at Barclays Plc in April 2022, with responsibility for Finance, including Tax, Treasury, Investor Relations and Strategy.

Anna is a chartered accountant and has worked in both banking and retail, holding various roles at Asda, HBOS and Lloyds Banking Group prior to joining Barclays. Since joining the Group in 2013, Anna was appointed Chief Financial Officer of Barclays Bank UK PLC in 2016, Group Financial Controller in 2019 and Deputy Group Finance Director in 2020. She joined the Group Executive Committee in February 2022, before taking up the role of Group Finance Director in April 2022.

Her notable skills, experience and contribution include: extensive accounting and financial services expertise; a deep understanding of banking and retail sectors; significant financial leadership experience of financial institutions

Email Anna on 100 Group matters at: Chair@the100group.co.uk

Our Committee Members

Anna Cross (Chair)

Barclays

Graeme Pitkethly (Deputy Chair)

Unilever

Kate Thompson

BP

Julie Brown

GSK

Andy Agg

National Grid

Stephen Daintith

Ocado

Sally Johnson

Pearson

Peter Cunningham

Rio Tinto

Phil Aspin

United Utilities

Recent consultation responses

CMIT open letter

The 100 Group co-signed CMIT’s open letter in response to the 2024 Autumn statement reflecting on the role of business to drive economic growth and to create meaningful and fulfilling jobs for everyone, across the UK, thereby securing the financial returns that ensure dignified and financially secure retirements for all.

CMIT letter to the Chancellor

The 100 Group co-signed the CMIT letter to the Chancellor highlighting the critical pivot point at which we find ourselves in the agenda to drive growth and returns to the UK economy, and the unprecedented breadth and depth of consensus around the challenges and support for significant change.

The Stakeholder Communications and Reporting Committee

Our aim is to promote relevant, concise and understandable communication with investors and other stakeholders, to support them in making rational economic decisions.

Our Role

Corporate reporting is management’s opportunity to communicate business performance and position to investors and other stakeholders alike. It is our position that only clear and meaningful reporting can effectively communicate to the ever widening group of users.

We engage to ensure that stakeholder needs are met in a well regulated, competitive environment that allows UK businesses to grow and compete internationally. As ESG continues to dominate the stakeholder agenda and an increasing number of regulators seek to make demands in the space, a focus on concise reporting is paramount.

We engage regularly with the IFRS Foundation’s International Accounting Standards Board and the newer International Sustainability Standards Board, as well as with The Department for Business and Trade, the UK Endorsement Board, and other relevant regulatory bodies.

We also maintain and develop relationships with other stakeholder bodies in the UK and internationally in order to best co-ordinate and focus efforts on areas of common interest.

Our Committee Members

Stakeholder Communications and Reporting Committee members are principally CFOs of FTSE100 companies, representing a broad spectrum of industry groups.

Our quarterly meeting cycle is supported by specialist members of their teams through the Environmental Social and Governance (ESG) Reporting and Traditional Financial Reporting (TFR) subgroups, both of which are chaired by Michelle O’Mara.

Michelle O’Mara is a Chartered Accountant with over 20 years’ experience in financial reporting. She is Head of External Reporting at PZ Cussons plc where her responsibilities include the Group’s external reporting and accounting policies. Prior to this she spent seven years at Smith & Nephew plc primarily in the role of Group Technical Accounting Director where her role included leading the Group’s transition to IFRS 9, 15 and 16, as well as in the audit practices of EY, KPMG, Grant Thornton, and PwC.

Our ESG And TFR subgroup meetings are supported by Danielle Stewart and Tiaan Fourie of RSM respectively.

Contact the Stakeholder Communications and Reporting Committee via the Group Secretariat at: secretariat@the100group.co.uk

Recent consultation responses

The Pensions Committee

Our aim is to promote fair, transparent and appropriate pensions regulation for employers and employees, which encourages long term investment in UK Plc.

Our Role

We actively engage with the Government, the Pensions Regulator, and the Pension Protection Fund (PPF) to enhance pension regulation in the UK, as well as with European Insurance and Occupational Pensions Authority (EIOPA) and the European Commission to ensure appropriate regulation on a European level.

We comment formally on significant relevant pension consultations and regularly advise relevant regulatory bodies on the future of pension provision.

Our Chair – Phil Aspin

Phil is CFO of United Utilities Group PLC. Prior to this, he held a number of senior finance leadership roles, including Group Controller and Group Treasurer.

Phil is a member of the ICAEW having qualified as a chartered accountant with KPMG and is a fellow of the Association of Corporate Treasurers. In March 2021, he was appointed as one of ten inaugural members of the UK Accounting Standards Endorsement Board (UKEB) having previously served a two year appointment as a member of EFRAG TEG (2015-2017). Phil holds a BSc in Mathematics from Durham University.

Our Committee Members

Pensions Committee members are drawn from Finance Directors, Group Treasurers and Pension Managers of member companies with an interest in the pension’s agenda.

Our pensions meetings are supported by Sankar Mahalingham of LawDebenture.

Contact the Pensions Committee at: pensions@the100group.co.uk

Recent consultation responses

Response to DWP’s call for evidence on Looking to the Future

While we support the DWP’s proposal to develop a long-term vision for workplace pension saving in the UK, we have material reservations and concerns about the proposals contained in this call for evidence on Looking to the future: greater member security and rebalancing risk.

HMT consultation on LTA abolition

Response to HMRC’s consultation on the proposed policy and draft legislation relating to the abolition of the Lifetime Allowance (“Consultation”)

Response to HMRC’s consultation on the abolition of the Lifetime Allowance

The 100 group set out our concerns regarding the proposals contained in the consultation on abolishing the pensions Lifetime Allowance published on 18 July 2023 and newsletter 152 issued on 20 July 2023.

The Tax Committee

Our aim is to promote a stable and competitive fiscal regime for employers and their employees, enhancing the competitiveness of the UK and delivering consistent revenue to the UK government.

Our Role

We believe that good fiscal policy is grounded upon:

- International competitiveness – encouraging good investment and international businesses locating and investing capital into the UK;

- Certainty – avoiding short term volatility, a clear tax roadmap and swift resolution of uncertainties; and

- Simplicity – clear and understandable tax rules.

We see three key areas of opportunity where tax might be used as a highly effective leverage to deliver long term investment – through Innovation; through Capital; and through People.

Opportunities in Innovation

- Supporting innovation in the round – not just separate regimes that look at R&D and patents

- A holistic joined up offering that extends beyond tax and considers the whole economic lifecycle of an investment

- Policy which supports ‘green’ innovation – which would align to the government ambition to be a leader in science and technology

Opportunities in Capital

- More up-front certainty – in line with the 10+year horizons for most large capital investments

- Modernising the definition of capital expenditure and rebalancing the timing between cash outflow and tax relief

Opportunities in People

- Offering relief for on-the-job training as well as for formal and vocational training

- Realigning apprenticeship Levy definitions to the skills gaps facing businesses, e.g. highly skilled workers; drivers; etc.

Total Tax Contribution

The Tax Committee continue to promote the contribution of The 100 Group members to the UK Exchequer and the wider economy through the Total Tax Contribution Survey (see the latest results here)

Our Chair – Andy Agg

Andy is Group CFO at National Grid. Prior to this he held a number of senior finance leadership roles across the Group, including Group Financial Controller, UK CFO and Group Tax and Treasury Director.

Andy is a member of the ICAEW and graduated with a BA(Hons) degree in History from the University of Bristol.

Our Committee Members

Tax Committee members are principally Heads of Tax at FTSE 100 companies. They represent a broad spectrum of industry groups as well as a mixture of domestic international spread.

Our Tax Committee meetings are supported by Tim Sarson and Stef Redmond of KPMG.

Contact the Tax Committee via the Group Secretariat at: secretariat@the100group.co.uk

Recent consultation responses

Tax Journal article – Pillar II

The 100 Group express caution around the forecast incremental revenue from the OECD’s BEPS global minimum tax initiatives, which seem at odds with our member expectations, a majority of whom expect to pay ‘nil or negligible’ incremental tax.

2023 Total Tax Contribution Survey

The 19th annual TTC survey shows that the FTSE100 continue to generate 10% of total government receipts with a total tax contribution of £90 billion (taxed paid and collected by the FTSE 100).